SUPPLY & DEMAND IN ICT OCCUPATIONS

A fairly steady month saw a mild contraction compared

to July-August 2018, with steady remuneration and

headline indices for roles. Some increases in

advertising during August suggest some increase in

market demand which may flow through into

September.

MARKET ACTIVITY

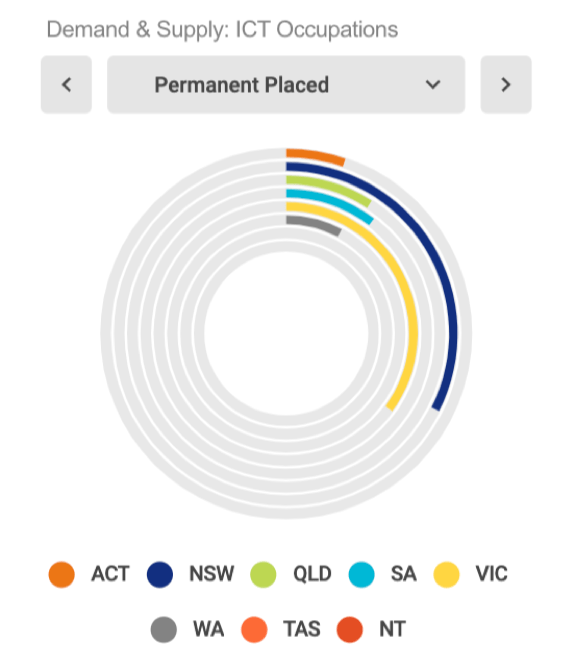

IT contractor renewals continued to fall

reaching 37% of activity, while new

contracts take the reins reaching 47%,

and permanent roles 12%.

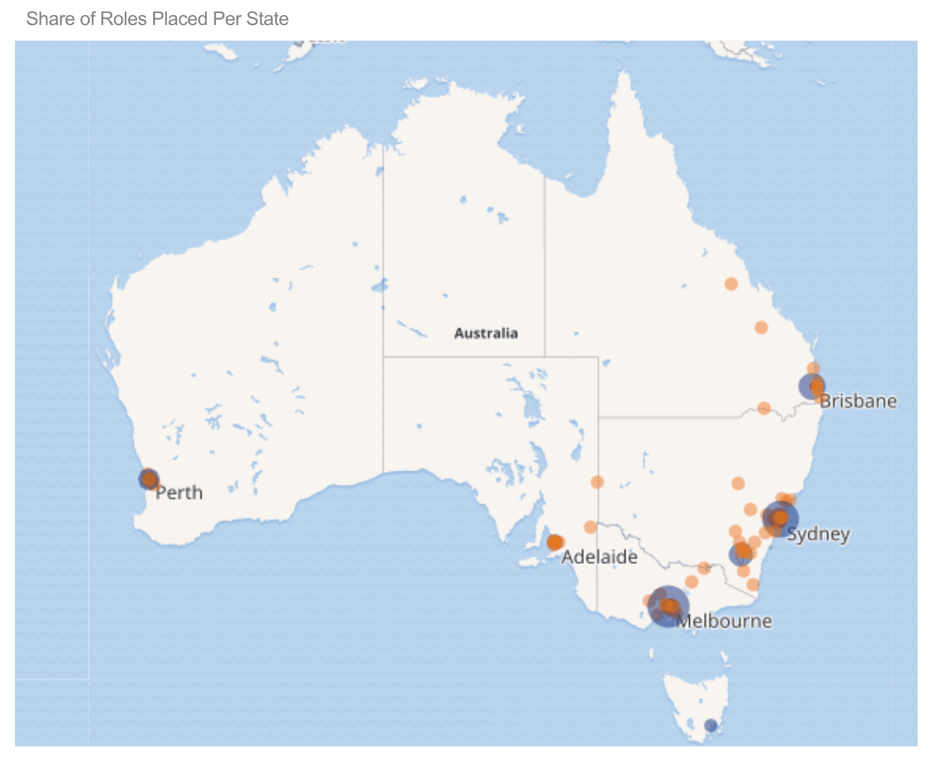

Melbourne activity reached 24.6% of

the nation’s placements, followed by

Sydney at 18.9% and Brisbane at

9.8%. Perth activity was 6.7%.

August activity saw a softening of 7%

on July, however the drop was less

pronounced than August 2018 and a

surge of advertising may create a

strong September 2019.

ICT HIRING DEMAND

Professional, Scientific and Technical Services demand

returned above 20% in August, followed by a small

increase in share by Public Administration and Safety.

Financial and Insurance Services lost its July surge,

returning to June comparability.

ICT demand had an even stronger surge in demand,

with August reaching 122% of the six-month rolling

average, from the 96% for July. This result is even

stronger than June which is at 115% for comparison.

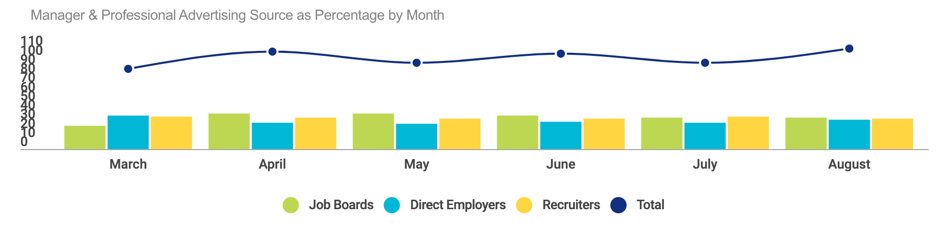

Share of advertising returned to job boards from

recruiters, in a reversal of July.

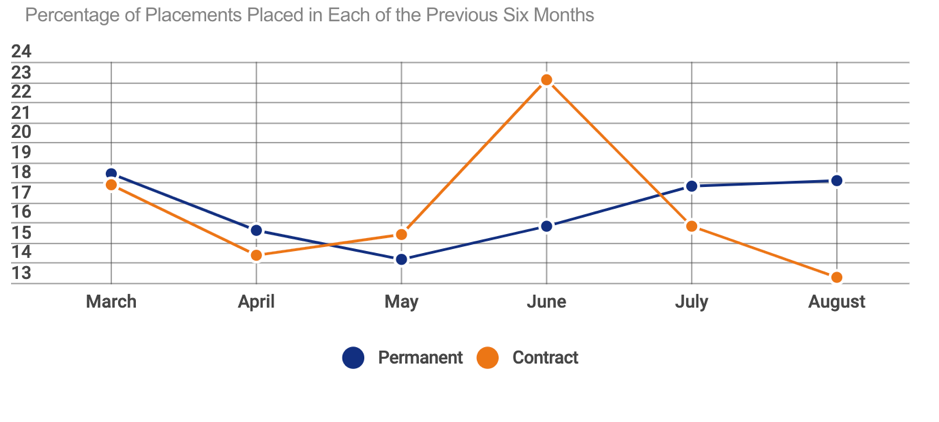

Rolling averages showed permanents placements maintained its strong performance remaining above the

benchmark (16.7%), while the contract market had its worst month in the six-month rolling average.

PROFESSIONAL ICT CANDIDATE SUPPLY

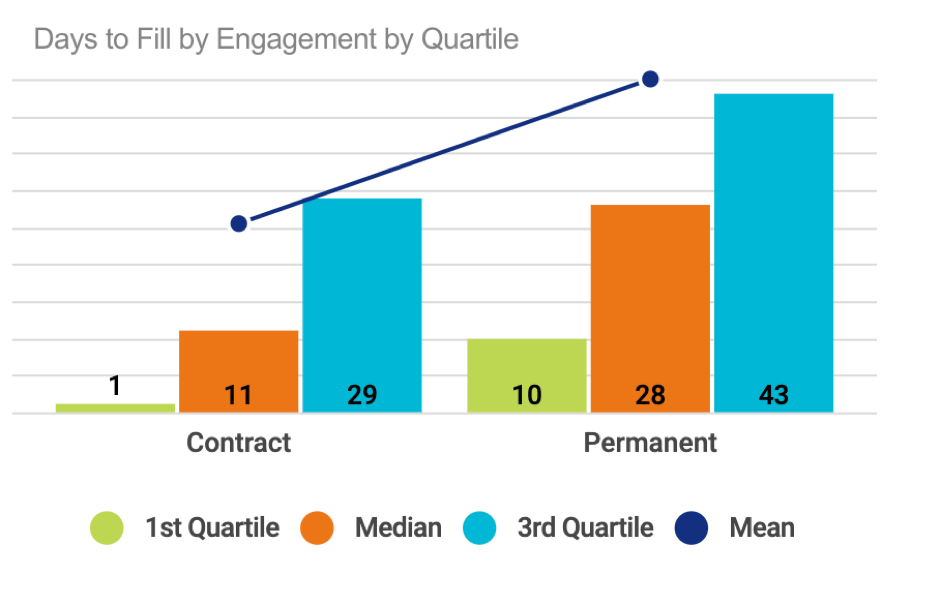

Time to place contracts returned to a mean of 17

days, a slight reversal to July. Permanent role

placement times continued to shrink to 30 days, from

a high of 35 days in May.

Business Analyst roles have become 5.2% of all

reported placements from a high of 6.6% in June,

while Project Management has gone down to 3.9%

from a high of 4.9%. IT Consultants are increasing in

presence, from 0.7% in June to 1.1% in August.

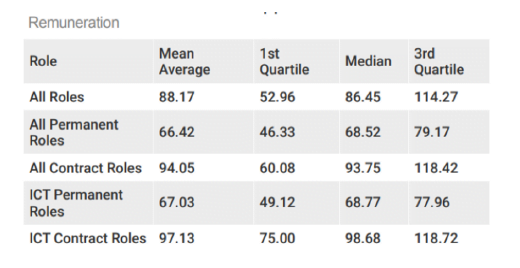

Renumeration mean averages for ICT permanent

roles are clearly lower in August, though all other

remuneration indices appear stable.

Data provided by APSCo Professional Staffing & Recruitment Trends Report.